7 defendants sentenced for conspiring to launder more than $11.8 million of online romance scam proceeds

COLUMBUS, Ohio – The final defendant charged in a conspiracy to launder the money generated from online romance scams was sentenced in federal court here today to 18 months in prison and three years of supervised release.

Kwame O. Yeboah, 38, of Columbus, conspired to launder more than $1.7 million through bank accounts in his control. As part of his sentence, Yeboah is ordered to pay the $1.7 million in restitution.

Yeboah and six other co-conspirators were convicted and sentenced for laundering the proceeds of online romance scams; they did not conduct the actual online scamming. The total amount generated by romance fraud that these individuals laundered was more than $11.8 million.

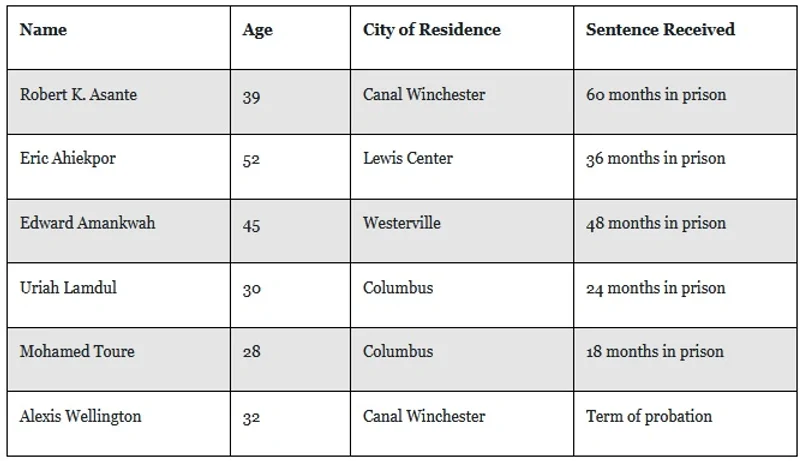

The other defendants convicted and sentenced include:

The romance scams involved individuals who created several profiles on online dating sites. They then contacted men and women throughout the United States and elsewhere, with whom they cultivated a sense of affection, and often, romance.

After establishing relationships, perpetrators of the romance scams requested money, typically for investment or need-based reasons, and provided account information and directions for where money should be sent. In part, these accounts were in the names of the defendants, their family members and their companies.

Funds were not used for the purposes claimed by the perpetrators of the romance scams. Instead, the co-conspirators conducted transactions designed to conceal, such as withdrawing cash, transferring funds to other accounts, buying official checks, sending wires to Ghana, China, the United States, and more. Part of the conspiracy was for the defendants to move the romance fraud proceeds from the United States to Ghana.

As part of their sentences, the defendants will pay the approximately $11.8 million in total.

Toure was also sentenced for money laundering as part of an unrelated COVID fraud scheme. Another individual submitted a fraudulent application for an Economic Injury Disaster Loan (EIDL). The U.S. Small Business Administration approved the COVID disaster-related loan and sent $110,000 in loan proceeds to Toure’s bank account. He then laundered the funds to conceal and disguise the fraud proceeds.

Ahiekpor was also sentenced for Wire Fraud for his role in defrauding the EIDL Program. In June 2020, he obtained a fraudulent $150,000 EIDL for his business. He spent the funds on two boats, an outboard motor, and a boat trailer. Ahiekpor committed part of his fraud scheme while on pretrial release for his money laundering charges, which means he will serve his Wire Fraud sentence after he completes his Money Laundering sentence.

The public can report online romance scams and other internet crimes at ic3.gov.

Experts offer tips for flagging romance scams:

Be careful what you post and make public online. Scammers can use details shared on social media and dating sites to better understand and target you.

Beware if the individual seems too perfect or quickly asks you to leave a dating service or social media site to communicate directly.

Beware if the individual attempts to isolate you from friends and family or requests inappropriate photos or financial information that could later be used to extort you.

Beware if the individual promises to meet in person but then always comes up with an excuse why he or she can’t. If you haven’t met the person after a few months, for whatever reason, you have good reason to be suspicious.

Never send money to anyone you have only communicated with online or by phone. Never provide your financial information or allow your bank accounts to be used for transfers of funds.

Requests for gift cards are also a red flag. The FBI has additional tips and information for protecting against romance and confidence fraud: https://www.fbi.gov/how-we-can-help-you/safety-resources/scams-and-safety/common-scams-and-crimes/romance-scams.

If you or someone you know is age 60 or older and has been a victim of financial fraud, help is standing by at the National Elder Fraud Hotline: 1-833-FRAUD-11 (1-833-372-8311). This U.S. Department of Justice hotline, managed by the Office for Victims of Crime, is staffed by experienced professionals who provide personalized support to callers by assessing the needs of the victim, and identifying relevant next steps. Case managers will identify appropriate reporting agencies, provide information to callers to assist them in reporting, connect callers directly with appropriate agencies, and provide resources and referrals, on a case-by-case basis. Reporting is the first step. Reporting can help authorities identify those who commit fraud and reporting certain financial losses due to fraud as soon as possible can increase the likelihood of recovering losses. The hotline is staffed 10 a.m.–6 p.m. Eastern Time, Monday–Friday. English, Spanish and other languages are available.

Kenneth L. Parker, United States Attorney for the Southern District of Ohio; and Bryant Jackson, Special Agent in Charge, Internal Revenue Service – Criminal Investigation (IRS-CI), announced the sentence imposed today by U.S. District Judge Sarah D. Morrison. Assistant United States Attorneys Peter K. Glenn-Applegate and David J. Twombly are representing the United States in this case.